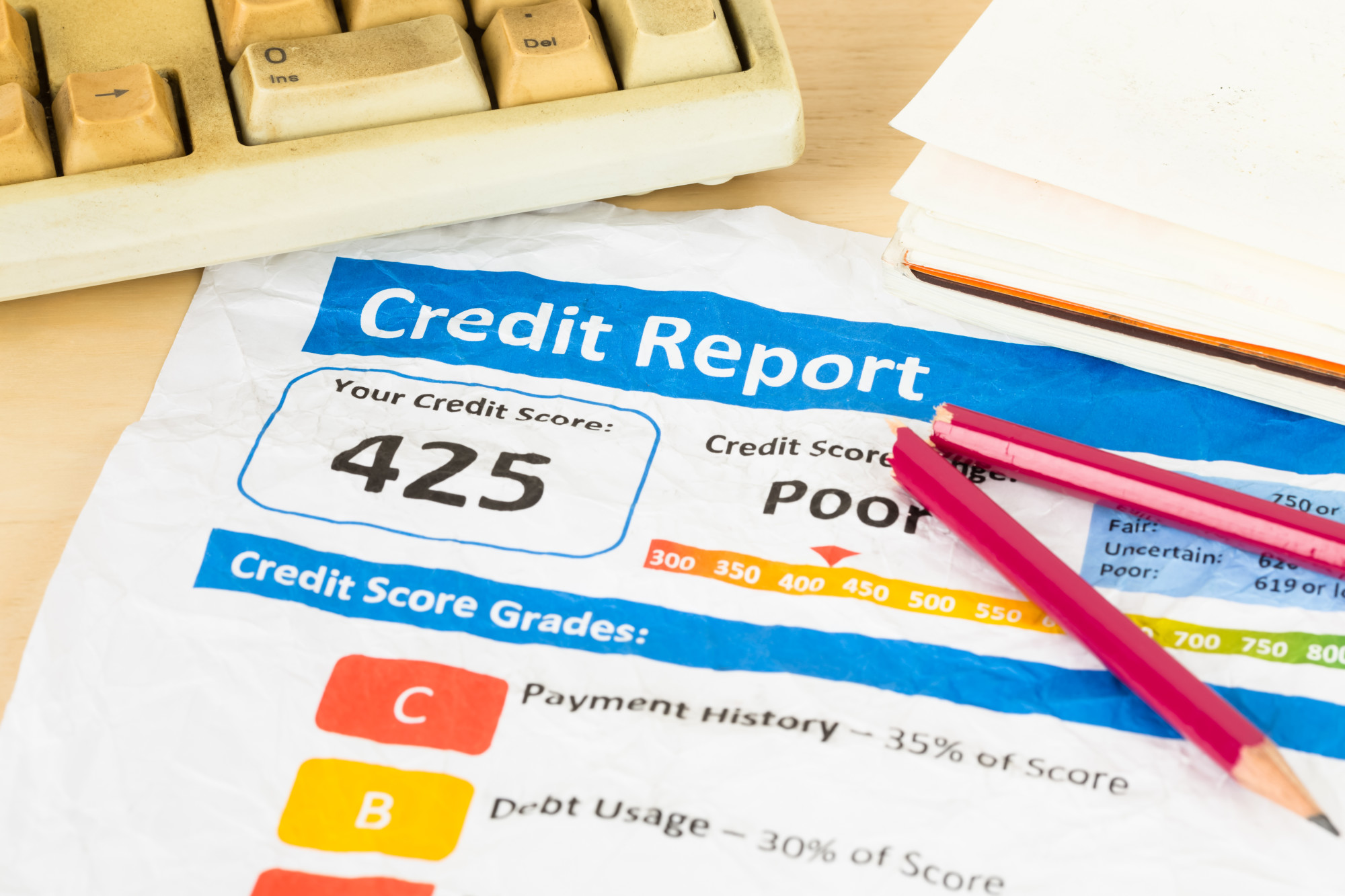

In Canada, credit scores above 660 are better than average, and that can help you get better interest rates and loans. But if you have a bad credit score, those things may be out of reach.

Luckily, you can use fast loans to improve your credit score. But keep reading to find out how you can use those loans to your advantage.

1. Keep It Small

If you have a bad credit score, you should take out smaller online loans. Larger loans will have higher monthly payments, or it will take longer to pay the loan back.

You should keep your cash loans small enough so that you can pay them off in full each month. Think about your other regular expenses and determine how much to pay.

While a lot of payday loans have fewer requirements than banks, you’ll still have some guidelines. Think about if there’s a minimum payment amount for a loan.

A smaller loan can be an excellent choice if you don’t have a ton of discretionary income. You can use the money you have to pay the loan back, and you can build your credit at the same time.

If you’ve never taken out a loan, you should also keep it small. You don’t want to go more into debt or make your bad credit score worse.

2. Take Out Multiple Loans

Another way to use online loans for your bad credit score is to take out more than one. Many things can determine your credit score, and credit diversity is one of them.

Lenders and credit bureaus like to see a variety of loans and credit lines. If you only have one, that can still help improve your score.

But if you can show that you can pay off multiple online loans, that’s even better. It can help raise your score higher, and you can leverage that to get a mortgage or another bigger loan.

However, you shouldn’t take out multiple payday loans unless you know you can pay them back. If you can only afford to pay for one, that’s okay.

Taking out one loan will help you credit much more than making partial payments to multiple loans. So consider your financial history and situation to decide how many loans you should get.

3. Save the Money

If you don’t need the money, you may wonder why you should take out fast loans. Anyone with a bad credit score can use loans to help. And if you don’t need the cash, you can save it.

You can create a separate bank account to manage the loan money, and you can use that account to pay it off. As long as you know that money is for your loan, you can keep it aside to help make payments.

Saving the money is a great option for people with a decent income but a bad credit score. After all, you don’t have to spend online loans once the cash is yours.

You can also save a small portion of the loan. If you need some of the cash, you can put the rest in your bank until your loan payment is due.

The more loan money you save, the easier it will be to pay it off. Plus, you won’t feel like you’re spending as much on your loan payments if it doesn’t eat into your budget.

4. Pay It Off Online

Taking out online loans is a great way to repair a bad credit score. But you can’t just take out the loan and be done.

You also need to pay off that loan throughout the entire loan term. Many companies that offer online loans also offer online payments.

You can use your bank account or debit card to pay off the balance. There’s no need to go to the bank or find the loan provider’s physical store.

As long as you have an online bank account, you can set up your payments. You may even be able to set automatic payments. But if not, you can set a reminder in your calendar to pay it off manually.

Online payments are quicker than paying by check or going into the store. Plus, you can pay it off when paying the rest of your bills, so you can easily remember to pay the loan.

5. Consider a Cosigner

If you want to improve your bad credit score and can’t get fast loans, you can look for a cosigner. A cosigner is someone who will sign the loan with you, and they will be equally responsible for paying it off.

Cosigners typically have a better credit score than the other person. But missing or late payments affect both of you.

You can ask someone you trust, such as your spouse or a family member, to cosign a loan with you. As long as you have enough combined money, it shouldn’t be too hard to pay it off.

Your cosigner can also hold you more accountable for making payments. If your cosigner doesn’t touch the loan money, they shouldn’t be the one to pay it back.

But they can remind you when the loan payments are due, and they can make sure you pay it off. While that may seem annoying, it can help you build your credit.

Things to Remember

When taking out online loans, you should consider a few things. First, while fast loans are great for improving your credit, they aren’t long-term solutions.

Once you improve your credit enough to qualify for credit cards and bank loans, you can switch to using those.

Also, you need to pay back any loan you take out to improve your bad credit score. Getting cash loans is part of the process, but so is paying them off.

Finally, you should consider your financial situation and your risk tolerance. Then, you can choose the right online loans for you.

Improve Your Bad Credit Score Today

A bad credit score can make it difficult or impossible to get a house or finance a car. But you can improve your credit score with smaller, online loans.

As long as you pay the balance in full, you can watch your credit score improve. Soon enough, you can take out larger loans to pay for bigger things.

Do you want a loan to help improve your credit score? Claim your cash now.